How to Get Participants for Your Study

This guide outlines the range of options available for getting respondents on Conjointly to help you choose the best one for your experiment.

Use a list of your customers or leads, or source respondents from elsewhere.

Target specific panel respondents

Buy responses from the panel network. Target them by location, demographics, and profiling questions.

Target specific pre-defined respondents (including those who are pre-defined for your company).

Use contacts from one of your audiences.

Market Test gives you quick human feedback on branding, concepts, and marketing assets from 100 real consumers in under two hours.

Quick feedback lets you test your experiment with ~50 experienced survey-takers within approximately six hours.

How to choose the source of participants?

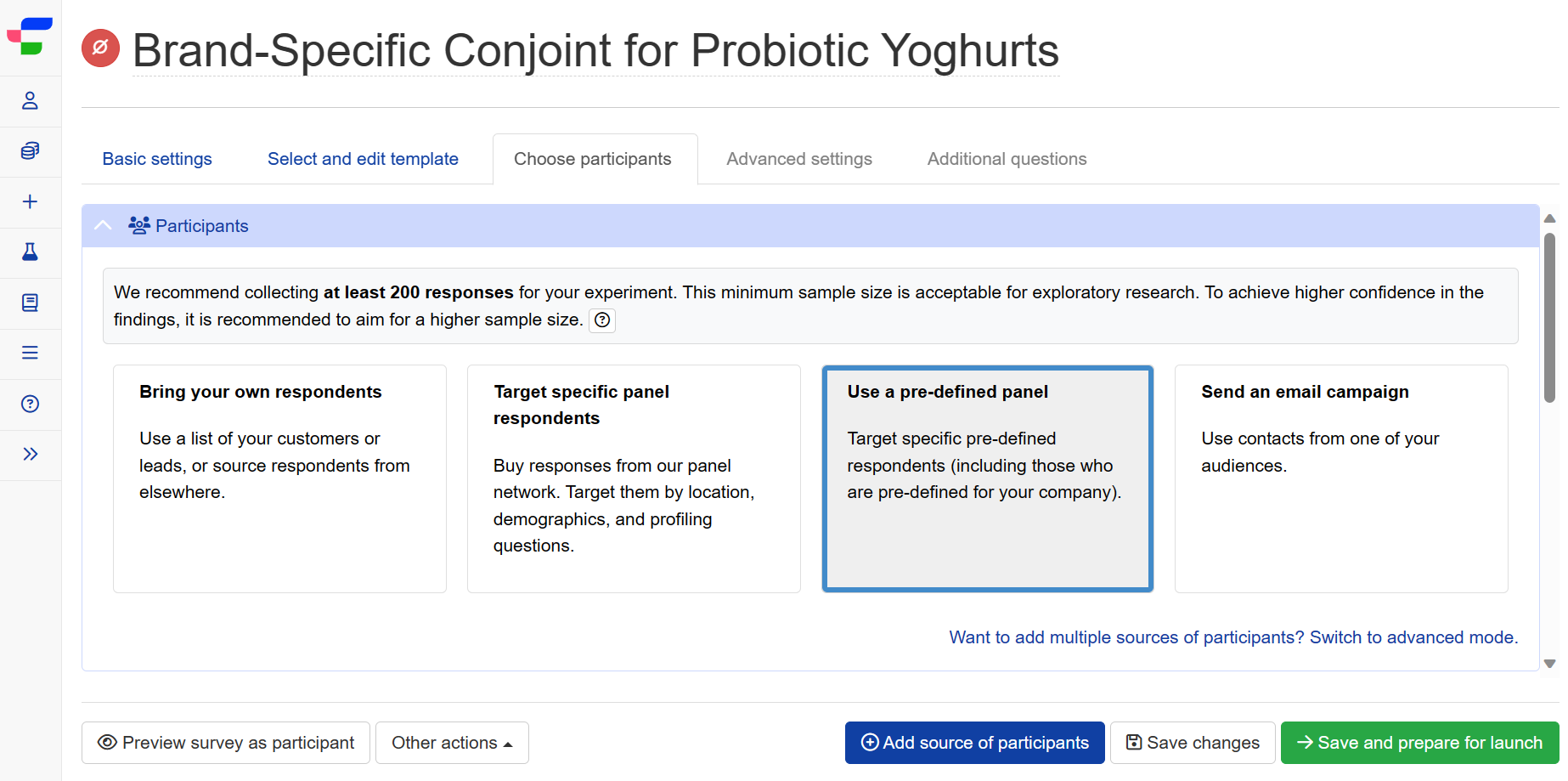

The Choose participants tab, located within your experiment setup page, allows you to select your desired source of respondents. Both the bring your own respondents and send an email campaign options offer convenient ways to distribute surveys to your existing contacts or mailing lists.

For high-quality responses from sources outside your current contacts, Conjointly delivers quality respondents directly into your survey via the target specific panel respondents or use a pre-defined panel options.

How to add multiple sources of participants?

To include multiple participant sources in your experiments:

- Click on Want to add multiple sources of participants? Switch to advanced mode.

- Select .

- Add your desired sources of participants accordingly.

All participant sources will be shown in the left panel in the advanced mode. Click on a participant source to manage or edit its settings.

How does Conjointly source respondents for your surveys?

With an extensive global network of sample providers, Conjointly grants you access to over 100 million panellists in 150 countries, ranging from the general population to deeply profiled audiences. If you have additional requirements for your panel, please reach out to the support team.

The Conjointly fieldwork team works diligently with panel partners to deliver quality respondents straight into your survey through the following process:

- Respondents sign up to one of our partners, who asks them an extensive list of profiling questions, including but not limited to demographics, shopping / spending habits, and the nature of the household.

- We determine feasibility and cost by analysing respondent profiles to achieve time and cost efficiencies. For example, if you need 100 iPhone users, we will send 100 survey invitations to people who have already identified themselves as iPhone users instead of inviting a larger generic sample size (e.g. 200 adults) in the hope of meeting the criteria. Furthermore, the more profiling we do, the more cost-effective the sample becomes, resulting in more accurate feasibility estimates.

- Once you launch an experiment with a pre-defined panel, we inform our panel providers to start inviting respondents from their panels to our survey link, using profiling where possible. Aside from receiving a survey link via email from the supplier, respondents may also find surveys on websites/apps the supplier operates.

- Respondents access the experiment through the survey link, which directs them to our screening questions. Respondents who do not meet the survey criteria (e.g. an Android phone user) are redirected back to the supplier. Qualifying respondents are redirected to Conjointly to complete your experiment. If our system detects that they are providing low-quality responses, they will be redirected to the supplier and identified as a “low-quality response”.

- Respondents are redirected to the supplier upon survey completion to claim their incentive. Subsequently, we may review the actual observed cost and feasibility of the pre-defined panel and make price or sample size adjustments as necessary.

How are panel costs calculated?

Panel costs are calculated per respondent and vary based on country, age, and other characteristics. The Conjointly platform quotes costs in real time as you complete the panel selection process. Once you launch your experiment, we will confirm the feasibility and immediately start data collection, which is normally completed in less than two days.

How are respondents compensated?

Our panel partners manage and provide incentives for the panellists, which may include monetary payouts, coupons, points, vouchers, charity donations, and lottery draws. Respondent participation is voluntary, and recruitment involves a double opt-in procedure and confirmation of personal information. As with other respondents, we monitor the quality of panel responses, and you will only pay for complete, quality responses.

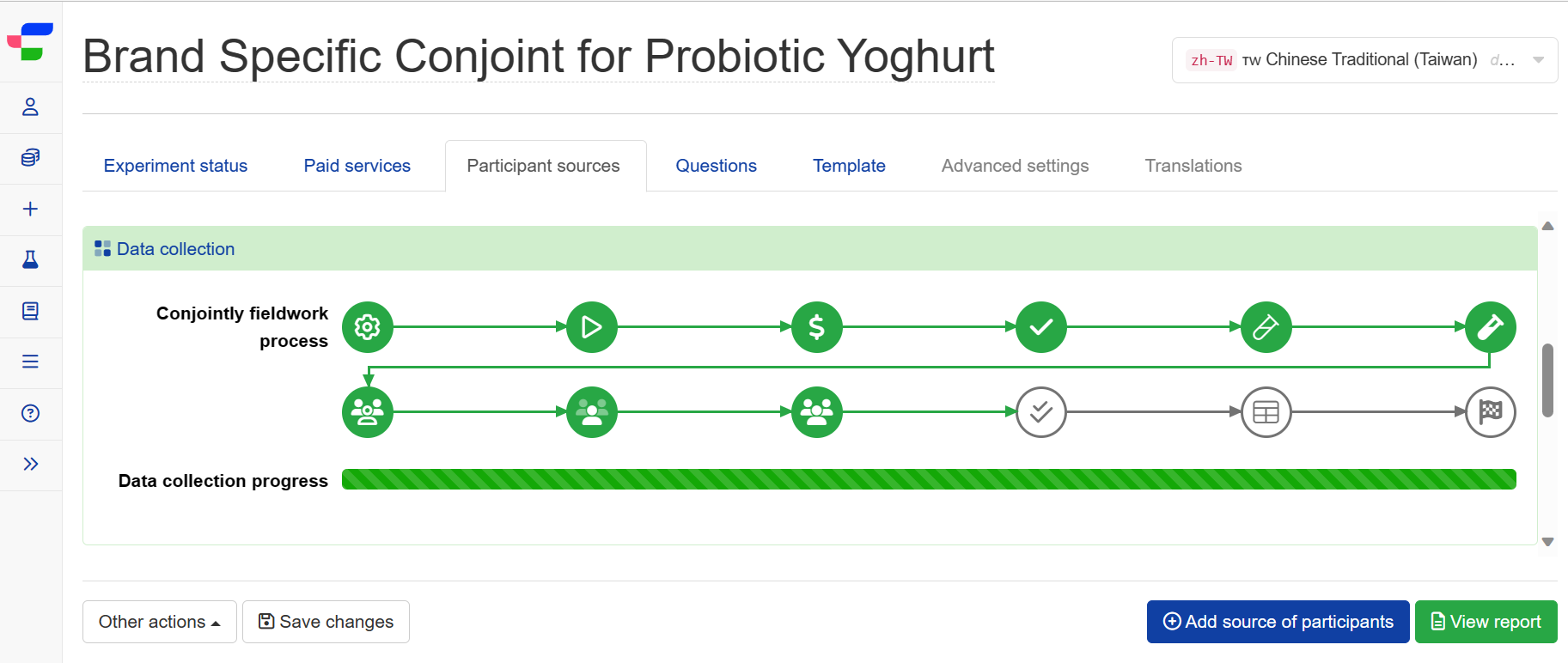

How to track your fieldwork progress?

When you select target specific panel respondents or a pre-defined panel, Conjointly fully manages the fieldwork process. You will receive live updates on the status of the fieldwork under the Participant sources tab.

FAQs

How many respondents do I need?

The system will automatically provide a recommended minimum sample size based on the settings of your experiment. This minimum sample size is acceptable for exploratory research. It is recommended to aim for a higher sample size if:

- You need to achieve higher confidence in the findings (e.g. when significant policy or managerial implications are attached).

- You are aiming to explore segments. For example, if you are looking to explore two or three pre-defined segments in your experiment (e.g. people split by age: under 20 years old, 21 to 40 years old, 41 and over), apply the recommended sample size to each of the three pre-defined segments.

It is fine to oversample if you keep the proportions of your groups (e.g., if you are aiming at a 50/50 female/male split, your sample should remain 50/50). In fact, the more respondents, the better for statistical robustness.

Does survey length affect the cost of the panel?

What is the optimal survey length?

We recommend keeping the survey length under 15 minutes to avoid respondent fatigue, which can affect result quality.

In the case of a conjoint study, conjoint questions typically take 4-7 minutes. For optimal results, we suggest incorporating any additional questions thoughtfully to keep the survey within the 15-minute threshold.

What demographic information is included with the purchased panel?

What is the difference between a hard and soft quota?

We achieve hard quotas to within a 5% margin of error. For example, a hard quota of 100 male and 100 female respondents will have at least 95 males and 95 females.

For soft quotas, we will attempt to fill the quota as best we can, but will prioritise keeping the speed of the data collection. Soft quotas are often used in regard to even spread of age, gender, income, or region. For example, we will attempt to spread the responses across all the income brackets, but we do not guarantee any specific numbers for any of the brackets.

What do I need to consider before launching a panel?

When launching your survey through targeting specific panel respondents or using a pre-defined panel, we recommend considering the following points:

- We will oversee all screening logic, quotas, survey redirects, and low-quality termination criteria. You can get in touch with us to ensure that your criteria are taken into account through your panel, rather than your experiment.

- We do not support external links when launching through a panel. For example, asking respondents to click on an external link to check out your product’s web page during the survey, is not supported.

- Once data collection is complete, our team will upload the results for all screening questions to your survey as external variables. This means you do not have to repeat screening questions in your survey so that respondents don’t have to answer the same question twice.