Brand-Specific Conjoint

Brand-specific conjoint is a discrete choice method for markets where potential product characteristics vary across brands or SKUs (it is commonly the case in FMCG, telco, home appliances, and tech). Technically known as choice-based alternative-specific/labelled conjoint design, it is used for:

- Feature selection for new or revamped products.

- Pricing your product, taking into account competitors' offerings and pricing.

- Testing branding, packaging and advertising claims.

Using Brand-Specific Conjoint to test preference share and revenue before resetting prices.

The survey flow consists of approximately 12 questions with different SKUs to choose from.

Brand-Specific Conjoint surveys can be automatically translated to more than 30 languages.

Bring your own respondents or buy quality-assured panel respondents from us.

Main outputs of Brand-Specific Conjoint

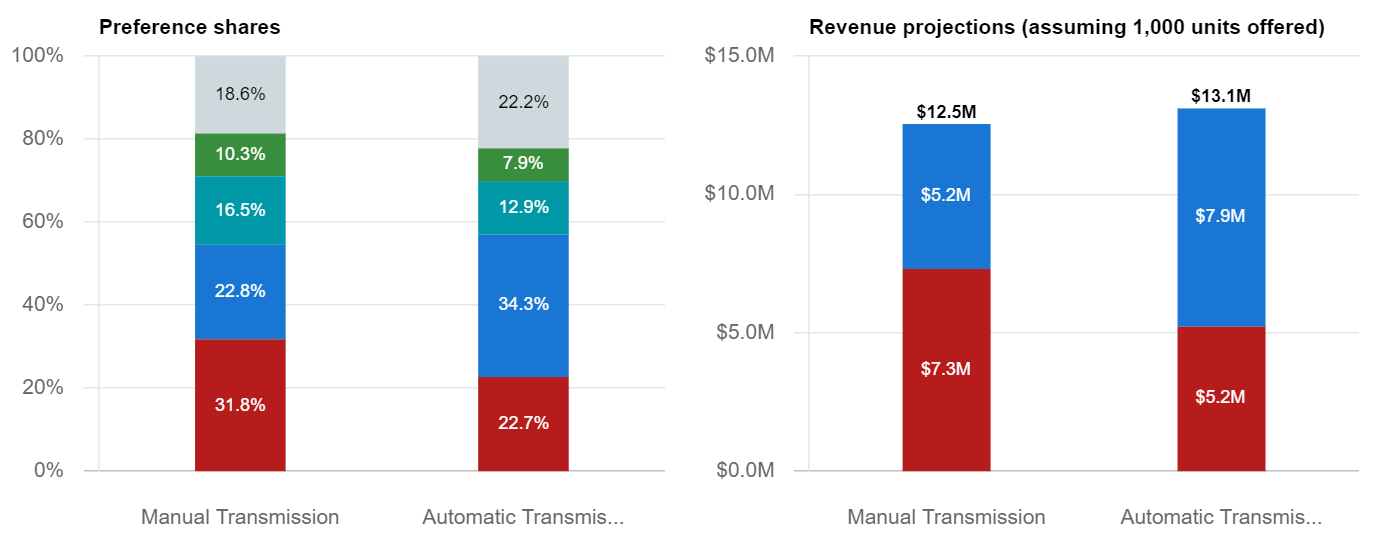

Share of preference simulation

Estimate share of preference based on customers' revealed preferences.

You can run "what-if" scenarios to see how consumers will behave if you change features of your product. Learn more about preference share scenario modelling.

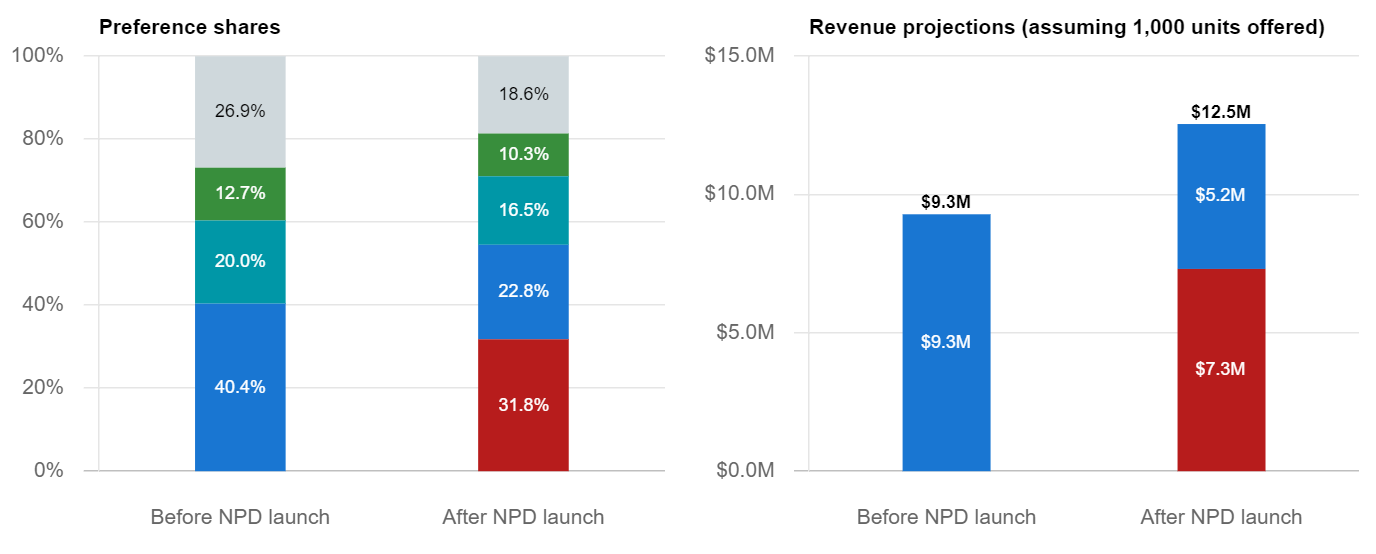

Understand amount of interest in new product launches

Through preference share simulations.

Run "what-if" scenarios to measure the amount of interest in new product ideas, compare with current SKUs and assess sources of business (i.e. if you are sourcing from competitors or cannibalising your product line).

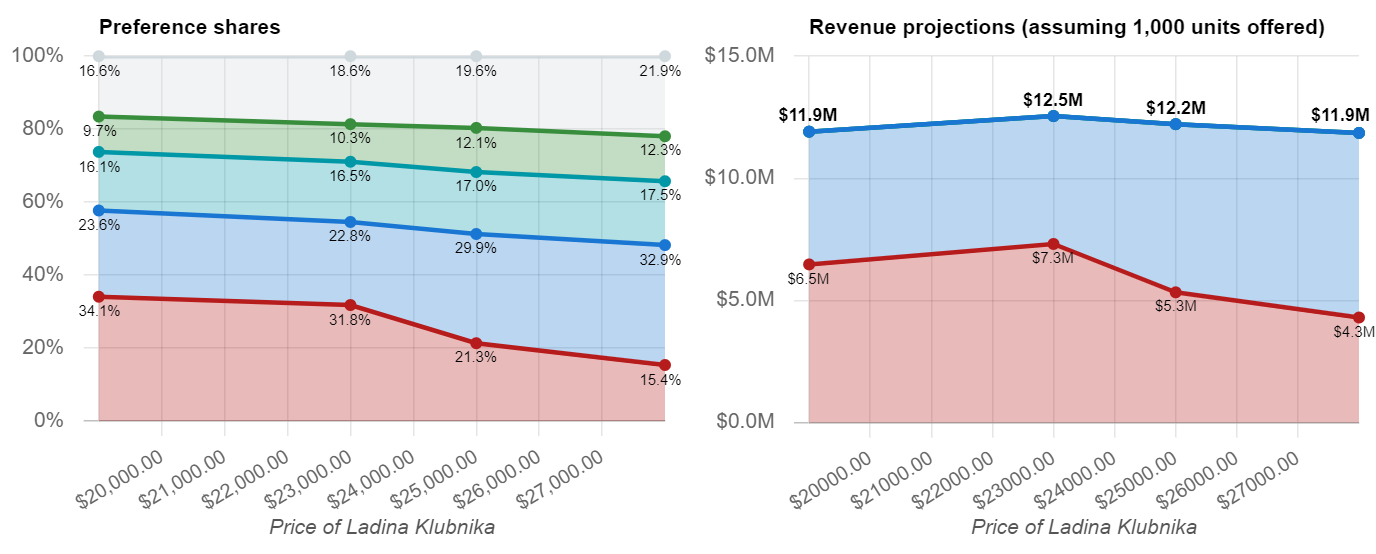

Price elasticity of demand

Estimate consumers' sensitivity to price changes and its effect on sales.

Run "what-if" scenarios to assess consumers' reactions to price increases or decreases in the context of your other SKUs and competitor offerings. Project revenue levels at different pricing options to select optimal pricing for your new or existing SKUs.

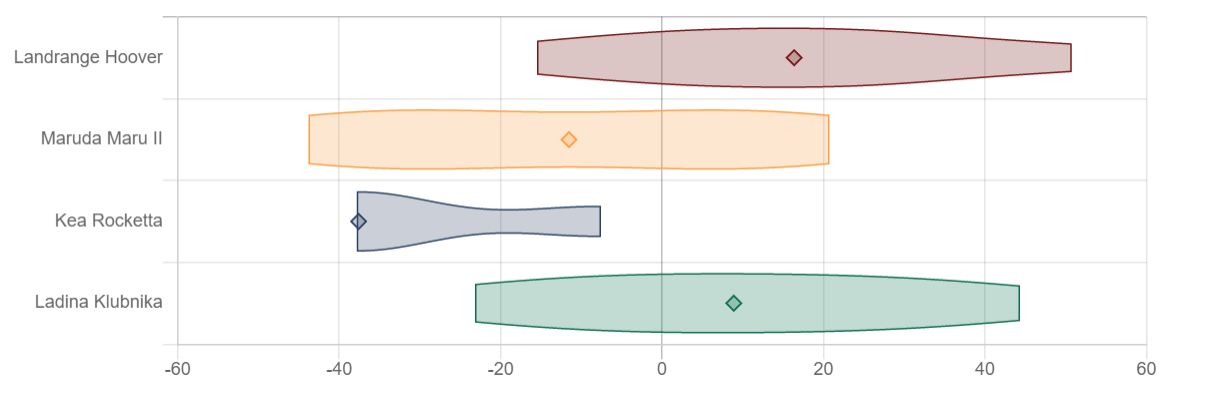

Relative performance of brands

Performance of different brands, considering their possible variants.

Conjointly estimates how strongly customers prefer different brands of products, taking into account the different variants (combinations of features and prices) presented to them. In this example, Landrange and Ladina tend to have more appealing variants than Kea.

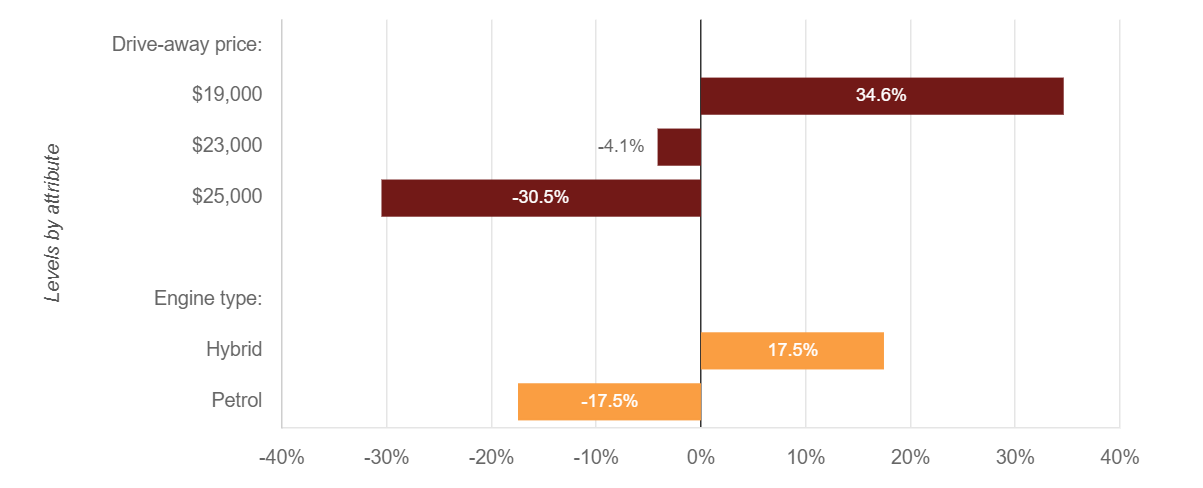

Partworth utilities

Importance of product characteristics and performance of different features.

Conjointly estimates how important each attribute is relative to the other attributes in customers' decision-making process (called relative importance of attributes).

Each level of each attribute is also scored for its performance in customers’ decision-making (relative performance of levels). In this example, Hybrid is preferred over Petrol for this brand.

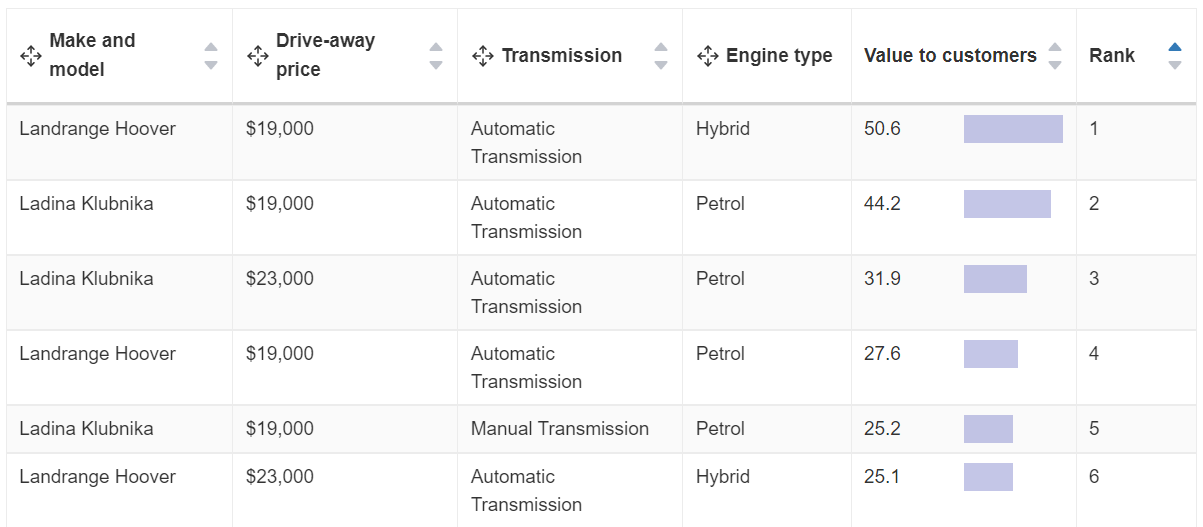

Ranked list of product constructs

List all possible level combinations and rank them by customers' preference.

Conjointly forms the complete list of product constructs using all possible combinations of levels. They are ranked them based on the relative performance of the levels that they combine. This module allows you to find the best product construct that your customers will prefer over others.

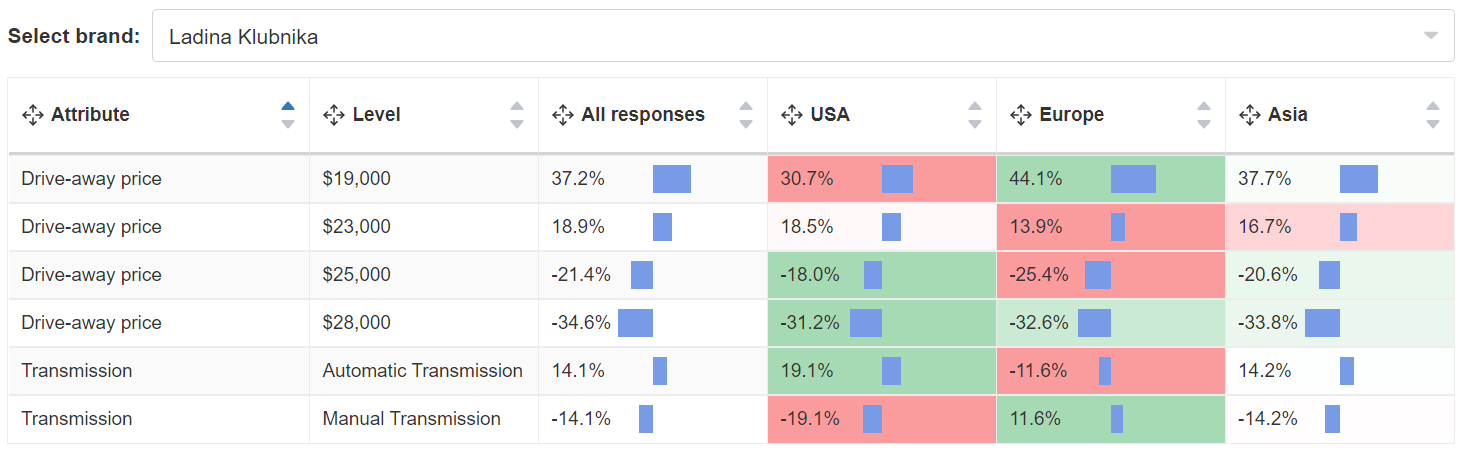

Segmentation of the market

Find out how preferences differ between segments.

With Conjointly, you can split your reports into various segments using the information collected automatically by our system, respondents' answers to additional questions (for example, multiple-choice), or GET variables. For each segment, we provide the same detailed analytics as described above.