How to Interpret Partworth Utilities

Partworth utilities (also known as attribute importance scores and level values, or simply as conjoint analysis utilities) are numerical scores that measure how much each feature influences the customer’s decision to select an alternative. Because partworths of attributes and levels in conjoint analysis are interrelated, in this post we will look at them using the same example of a mobile plan.

Suppose a company wants to find out customers’ preferences for mobile plan to reassess its product range, as a pathway to growth. They are investigating the following four attributes, to see which combination of levels within the attributes creates an optimal plan.

- Price: $70 per month, $50 per month, $30 per month

- Data included: 500MB, 1GB, 10GB, unlimited

- International minutes included: 0 min, 90 min, 300 min

- SMS included: 300 messages, Unlimited text

Relative importance by attribute (Attribute partworths)

The relative importance of each attribute shows its importance relative to other attributes. Values in this chart sum up to 100%. At 43.8%, the “Data included” attribute turns out to be the most important attribute with “International minutes included” being the least important attribute. It appears price is not as important a factor as “Data included”.

Attribute partworths are calculated as the average of each respondent attribute partworths utility. Each respondent’s attribute partworths are calculated with the range of preference to levels within the attributes.

This chart shows how strongly the variations of attributes affect customers’ choice, but only for the levels that you chose in the design. If a more extreme level were added to one of the attributes, that attribute would likely become higher in importance. For example, if we add a more extreme price level ($150 per month), customers are likely to shun it and therefore the partworth of that level will be very negative, which will in turn inflate the importance of the whole price attribute.

Relative value by level (Level partworths)

Level partworths allow you to dive deeper to understand what specific levels within an attribute drive customers’ choice. In this example, unlimited data plan is strongly preferred to 500MB data and 1GB plan and somewhat to 10GB data plan.

Level partworths are calculated based on the average preference scores for each level. Levels that are strongly preferred by customers are assigned higher scores, levels that perform poorly (in comparison) are assigned lower scores. The chart is scaled so that, for each attribute, the sum of all positive values equals (the absolute value of) the sum of all negative values.

Again, it is important to remember that these partworths are relative. If we add a new level for the attribute “Data included”, the relative value of each level will change.

Distribution of preferences for levels

This chart shows the distribution of preferences for various levels. It answers the question: Assuming that each consumer has a preference for different levels, what is the distribution of preferences for different levels (within each attribute) across consumers?

This information allows you to dive deeper to understand the preference distribution for various levels within an attribute. In this example regarding data plans, 83.2% of total preference goes to unlimited, 10.3% for 10GB, 3.6% for 1GB, 2.9% for 500MB. Unlimited data plan is strongly preferred to 500MB data and 1GB plan and somewhat to 10GB data plan.

Distribution of preferences for levels are based on the ratio of preference scores for levels within the attribute for each respondent. Levels with high percentages of preferences are more preferred within attribution across all respondents.

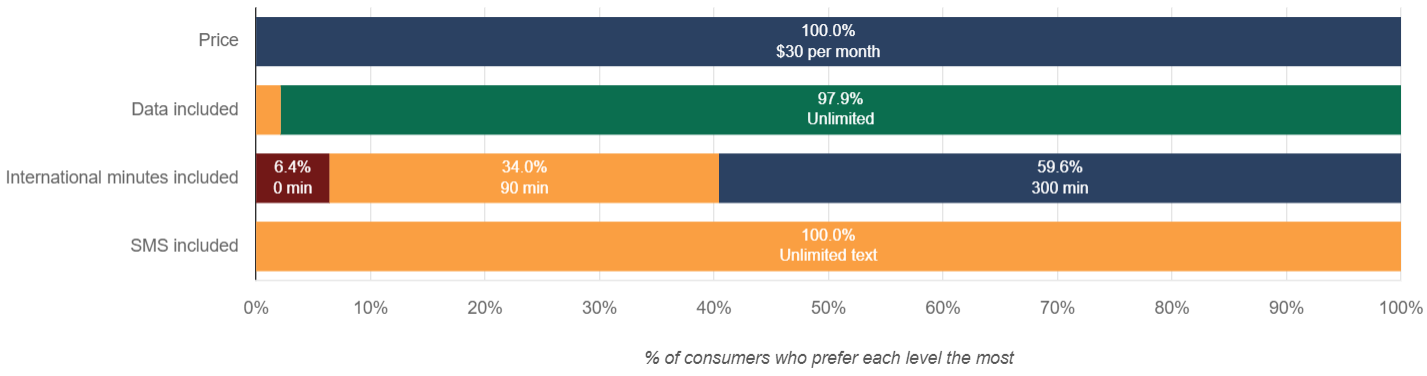

Distribution of most preferred levels

This chart shows the distribution of levels most preferred by consumers. It answers the question: Assuming that each consumer likes different levels, how many consumers have each level as their most preferred

Following the same example of mobile data plans, 97.9% of respondents most-preferred plan unlimited data, with 2.1% of respondents most preferring 1GB. Therefore, unlimited data is easily the most preferred level among mobile data.

Distribution of most preferred levels is calculated with the percentage of respondents choosing the specific level as the top preferred option within attributes. High percentage of this value represents the level is most preferred by big percentage of consumers.

Ranked list of product concepts

For each report, Conjointly will present a “ranked list of product concepts as preferred by customers”. This is a list of some (but very often not all — because they can count in millions) potential combinations of features and prices that represent product concepts. The column “Value to customers’’ will contain a single number for each concept combination (row) with specific features and price levels. This number is calculated as the average partworths across individual respondent’s total partworth utility scores for the combination. It is scaled with 0 as the average value.

The first rank combination is the most preferred concept across respondents. In this example, a mobile plan of $30 per month, unlimited data included, 300 min internal included and unlimited text included has the highest overall utilities across respondents.

If there are too many possible combinations (over 500), the system will take a sample of 500 combinations and present them in the ranked list. Therefore, the list is not always exhaustive.

Distribution of preferences for brands

For Brand-Specific Conjoint, Conjointly presents the distribution of preferences for different concepts by brand. You can assess the chart via Brand preferences under Insight tab.

This violin chart compares preferences for brands and helps you identify which brands have more or less variation by the constituent concept. Each violin-shaped plot shows the scores of different combinations of features within each brand/SKU. Median values are shown as the diamonds in the middle of the violin.

The width across each violin shows how scattered are the scores of different concepts. In areas where you have a wider violin plot, that’s where you have more concepts. In the example above, Kea Rocketta has more concepts on the lower end, while Maruda Maru II and Ladina Klubnika have a relatively evenly distributed spread.

You can compare the chart with the Ranked list of product concepts as preferred by customers below to get a better understanding of the spread. Again in this example, Kea Rocketta has two concepts on the low end and one on the high end, resulting in a wider plot on the low end.

In interpreting the violin chart, it is important to remember that the relative performance of a brand will be affected by the features that are applied to that brand, especially if one of the brands was shown with unusual or unrealistic features or price levels.

The scale of this chart is arbitrary, but it is consistent with the ranked list of product concepts described above. But it is not consistent with attribute partworths and level partworths.

FAQs

Do partworth utilities show variability of preferences across consumers?

Why do importance scores always sum up to 100% in Brand-Specific Conjoint?

Next steps

- Learn more about how to calculate partworth utilities.

- Review an example report on preferences in ice-cream.

- Learn more about preferences scores in claims tests.

- See more example conjoint reports in your experiments.